Self-Managed Super Fund (SMSF)

A Self-Managed Super Fund (SMSF) is a private superannuation fund that you manage yourself. It provides greater control over your retirement savings and investment decisions compared to retail super funds. People use SMSFs to reduce fees, gain investment flexibility, and optimize tax outcomes, especially when they have sufficient superannuation balance (typically $200,000+ combined with family and friends) to make the compliance costs worthwhile.

SMSF benefits

- Investment Control: Choose any investment allowed by law, including direct shares, property, and alternative assets

- Lower Fees: Typically $1,500/year vs 0.5%+ for retail funds, which can save thousands annually on larger balances

- Tax Efficiency: 15% tax on contributions, 10% on capital gains (vs 15% for retail funds), and 0% tax in pension phase

- Pension Phase: 0% tax on income and capital gains once you transition to pension phase

- Family Pooling: Can combine super with family members to reach cost-effective balance thresholds

SMSF Structure

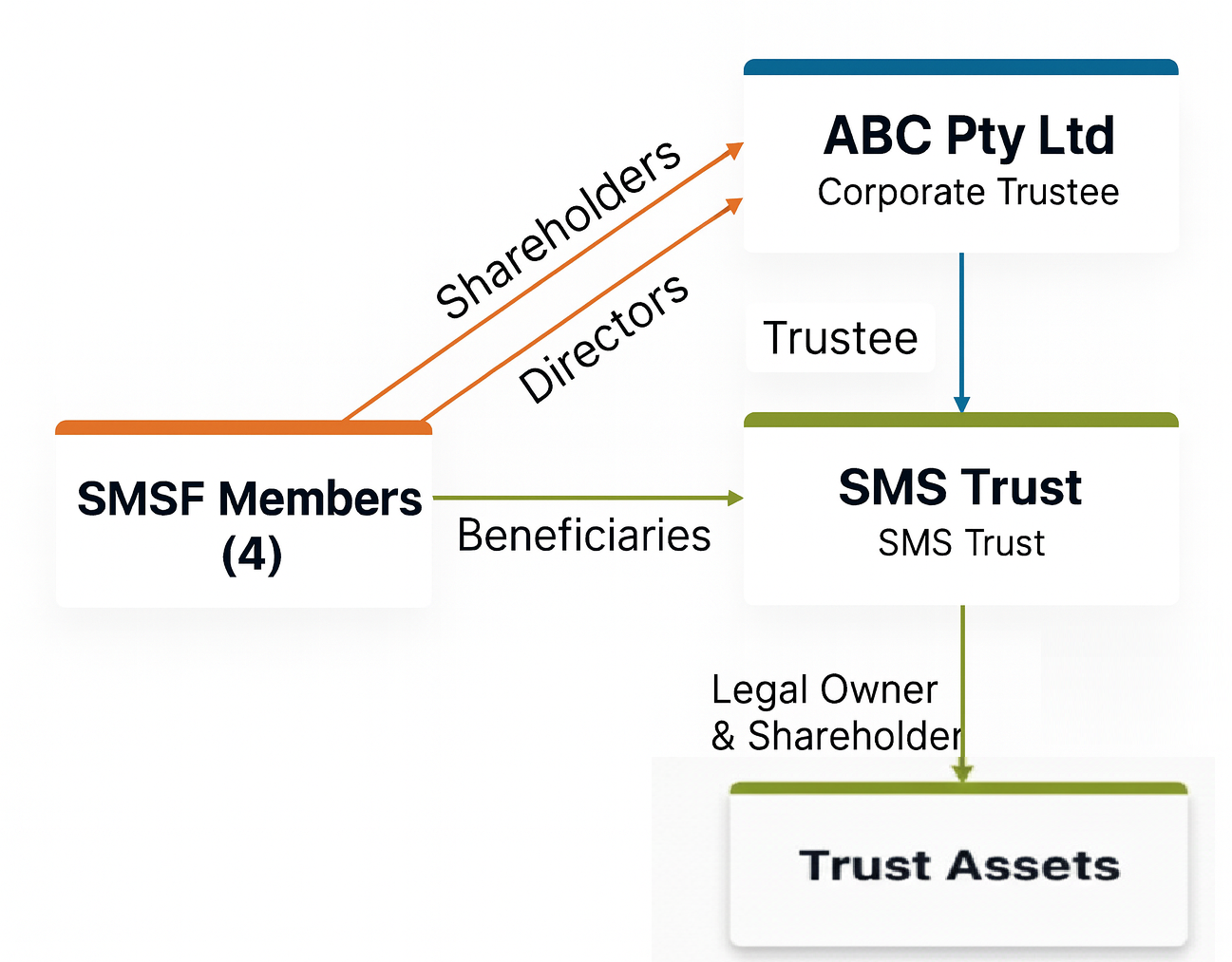

The diagram below shows the typical SMSF structure with a Corporate Trustee:

A typical SMSF structure with members, a corporate trustee, the SMSF trust, and its assets.

SMSF Members are both shareholders and directors of the Corporate Trustee company, which acts as the Trustee for the SMSF Trust. The Trust holds all the SMSF assets, and the Members are the beneficiaries of the Trust.

SMSF Considerations

- Compliance: Must meet ATO requirements and regulations, including annual audits and reporting

- Time Commitment: Requires ongoing management and administration, including record keeping and investment decisions

- Minimum Balance: Generally need $200,000+ combined balance to be cost-effective compared to retail funds

- Trustee Responsibilities: Legal obligations as trustee, including understanding superannuation law

- Setup Costs: Initial establishment costs and ongoing compliance fees

SMSF Investment Options

SMSFs can invest in a wide range of assets, providing flexibility that retail funds often don't offer:

- Shares & ETFs: Direct share ownership and exchange-traded funds on Australian and international markets

- Property: Residential and commercial property investments, including direct property ownership

- Alternative Assets: Private equity, collectibles (with restrictions), and other alternative investments

- Cash & Fixed Interest: Term deposits, bonds, and other fixed interest securities

Investment Restrictions

SMSFs have restrictions on related party transactions, in-house assets, and certain investments. It's important to understand these rules before making investment decisions.

When to Set Up an SMSF

Consider setting up an SMSF when:

- You have at least $200,000 in combined superannuation (with family/friends) to make it cost-effective

- You want more control over your investment decisions

- You're paying high fees in retail super funds (0.5%+ annually)

- You want to invest in assets not available through retail funds (e.g., direct property)

- You're approaching or in pension phase where tax benefits are maximized

Tax Benefits

SMSFs offer significant tax advantages:

- Accumulation Phase: 15% tax on concessional contributions and earnings (vs up to 47% for personal investments)

- Capital Gains: 10% tax on capital gains for assets held more than 12 months (vs 24% for individuals)

- Pension Phase: 0% tax on all income and capital gains once you start a pension

- Concessional Contributions: Tax deduction for contributions up to $30,000 per year (or more with carry-forward caps)

Tax Strategy

Many people use SMSFs to hold capital-appreciating assets (like property or shares) that they can transition to pension phase without selling, avoiding capital gains tax entirely.

How to Set Up an SMSF

Setting up an SMSF involves several steps:

- Trust Deed: Create a trust deed which establishes the SMSF and outlines trustee powers, member rights, and investment rules

- Trustees: Appoint trustees (individuals or a corporate trustee) - all members must be trustees

- Register with ATO: Register the SMSF with the ATO and obtain an ABN and TFN

- Bank Account: Open a dedicated bank account in the trustee's name (or company's name if using a corporate trustee)

- Broker Account: Set up a broker account in the trustee's name (or company's name if using a corporate trustee) for share and investment trading

- Investment Strategy: Prepare a written investment strategy that outlines the fund's investment objectives and how they will be achieved

- Member Applications: Complete member application forms and rollover any existing superannuation balances

Corporate Trustee Option

You can choose to have individual trustees (each member is a trustee) or a corporate trustee (a company acts as trustee). Corporate trustees provide better asset protection and can make succession planning easier, but have additional ASIC fees.

Account Ownership

It's critical that bank and broker accounts are opened in the trustee's name (or company's name if using a corporate trustee), not in members' personal names. This ensures proper separation of SMSF assets and compliance with superannuation law.

Ongoing Compliance

SMSFs require ongoing compliance activities:

- Annual Audit: Must be audited by an approved SMSF auditor each year

- Annual Return: Lodge annual return with the ATO (SMSF tax return)

- Investment Strategy Review: Review and update the investment strategy regularly (at least annually)

- Record Keeping: Maintain detailed records of all transactions, investments, contributions, and benefit payments

- Asset Valuation: Value all assets at market value each year for reporting purposes

- Benefit Payments: Ensure benefit payments comply with superannuation law (preservation rules, minimum pension payments, etc.)

- Compliance with SIS Act: Ensure all investments and transactions comply with the Superannuation Industry (Supervision) Act

Compliance Requirements

SMSFs must comply with strict rules including restrictions on related party transactions, in-house assets, and borrowing. Non-compliance can result in significant penalties and loss of tax concessions.

Tax Reporting

SMSFs require several tax reporting documents:

- SMSF Annual Return: Annual return (formally lodged with the ATO) showing fund income, expenses, contributions, and benefit payments

- Financial Statements: Balance sheet and operating statement showing fund financial position

- Member Statements: Statements for each member showing their account balance, contributions received, and benefits paid

- Audit Report: Annual audit report from an approved SMSF auditor

- Capital Gains Reporting: Details of any capital gains or losses, including application of CGT discount

- Contribution Reporting: Details of all contributions (concessional and non-concessional) received during the year

SMSFs must lodge their annual return by the due date (typically 15 May for funds with a June 30 year end). The audit must be completed before the return can be lodged.