Structuring strategy

The right structure can significantly impact your after-tax returns, asset protection, and flexibility. Different structures offer different benefits for tax minimization, asset protection, and investment control. There are many different structures available, but this guide will focus on the three most common structures: SMSF, Family Trust, and Companies.

The key is to use the right structure for the right purpose, often combining multiple structures to optimize tax, protection, and flexibility.

When the time is right most people would get a benefit from following these steps:

- SMSF - with family and friends once you have on average $200k combined in investments

- Family Trust - when you have more than 100k to invest with outside of Super

- Company - when you are running a small business, or you have enough income from your family trust that you are exceeding the 30% tax bracket for all beneficiaries

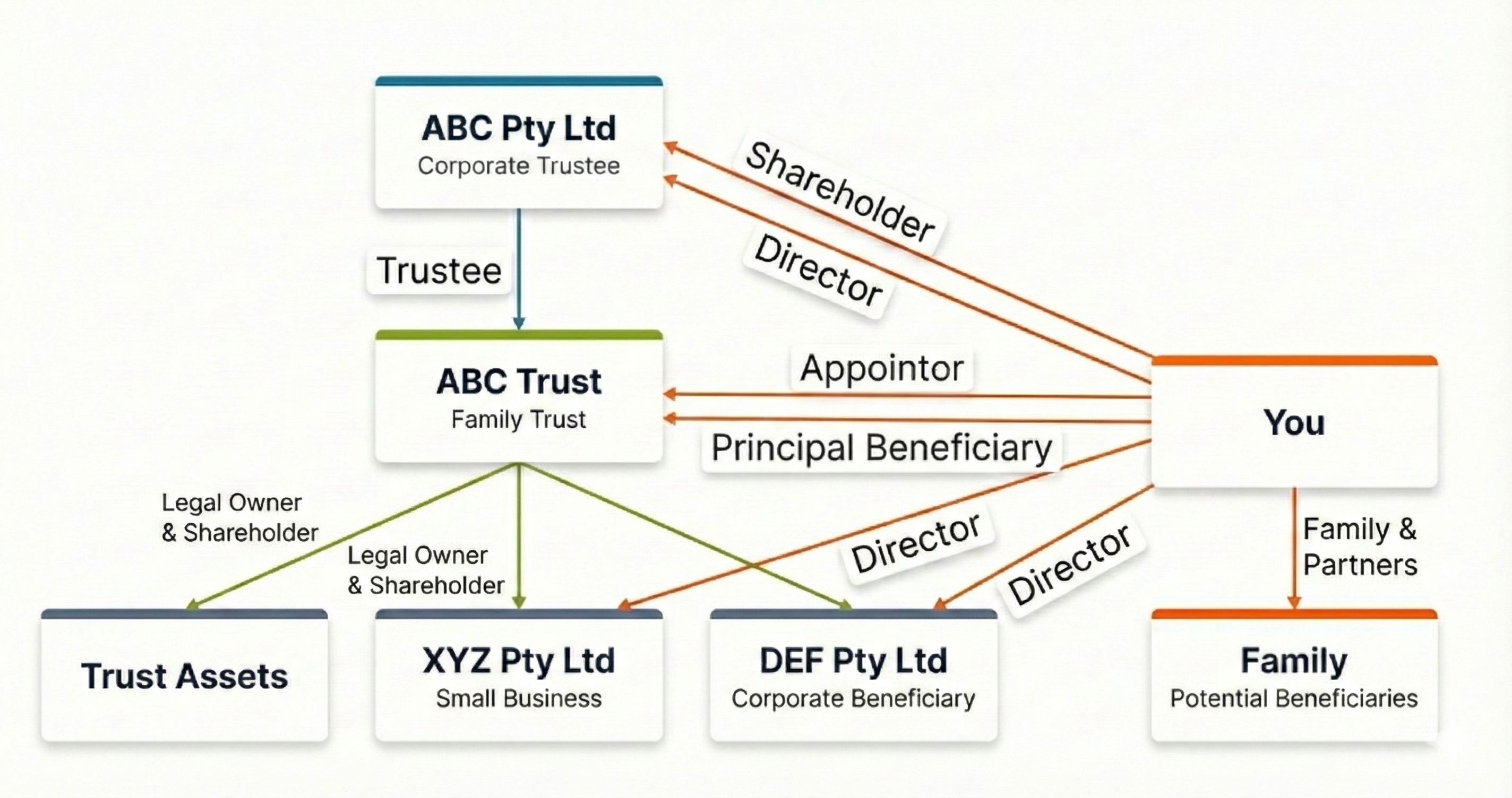

Typical structure diagram

The diagram below shows how these structures typically work together, with a Corporate Trustee managing a Family Trust that holds assets and distributes income to a Corporate Beneficiary when needed:

A typical family trust structure with a corporate trustee, corporate beneficiary, and small business.

This structure allows you to optimize tax through strategic income distribution, protect assets through the trust structure, and maintain flexibility through the corporate trustee and beneficiary arrangements, all while maintain full control over your investments and assets.

Self-Managed Super Fund (SMSF)

A Self-Managed Super Fund is a private superannuation fund that you manage yourself, providing greater control over investment decisions and typically lower fees than retail funds. People use SMSFs to reduce fees (typically $1,500/year vs 0.5%+ for retail funds), gain investment flexibility, and optimize tax outcomes, especially when they have sufficient superannuation balance (typically $200,000+ combined with family and friends) to make the compliance costs worthwhile.

Family Trust

A Family Trust (Discretionary Trust) is a legal structure that holds assets for the benefit of family members, providing flexibility in distributing income and capital gains to minimize tax while offering asset protection. People use Family Trusts when they have more than $100,000 to invest outside of superannuation, as it allows them to distribute income to family members with lower tax rates (potentially reducing tax from 47% to 0-19%) and protect assets from personal creditors.

Company

A Corporation or Company (which can act as a Business, Corporate Trustee or Corporate Beneficiary) is a legal entity that has many of the same abilities as a person. It can also be classed as a family member to receive distributions from a Family Trust or operate as a standalone business, providing tax rate caps (25-30%) and limited liability protection. People use companies when running a small business, or when they have enough income from their family trust that all beneficiaries are exceeding the 30% tax bracket, allowing them to cap tax rates at 25-30% instead of 47% and retain earnings for future investment.

Unit Trust

A Unit Trust is a structure where investors hold units (similar to shares) in the trust. Each unit represents a fixed entitlement to income and capital, unlike discretionary trusts where distributions are at the trustee's discretion.

Unit Trusts provide clear ownership structure with defined units that can be bought and sold. They are often used for joint investments, property investment trusts, private equity funds, and infrastructure investments where multiple investors need fixed entitlements.

Downsides Compared to Family Trusts

While Unit Trusts clearly outline ownership of assets, they have significant downsides compared to Family Trusts:

- Tax Inefficiency: Cannot stream income tax efficiently - income must be distributed according to unit holdings, preventing strategic distribution to lower-tax-rate beneficiaries

- Double Taxation: Can cause double taxation on sale of units - the trust may pay capital gains tax, and then unit holders may pay tax again when they sell their units

Education Bonds

Education Bonds are investment products designed to save for children's education expenses. They offer tax benefits if held for 10+ years and can be used for any education expenses. They offer asset protection similar to family trusts and have no contribution limits unlike superannuation.

Downsides Compared to Family Trust + Corporate Beneficiary

Education Bonds provide no additional benefit over a Family Trust + Corporate Beneficiary structure, but with many significant downsides:

- Lack of Investment Choice: Limited investment options compared to SMSF or Family Trust - you're restricted to the bond provider's investment options

- Lack of Spending Choice: While marketed for education, the restrictions and rules around withdrawals can be complex and limiting

- Higher Fees: Percentage based fee structure which can become more costly than a Family Trust at larger balances

- 10-Year Lock-in: Must be held for 10+ years for tax benefits, reducing flexibility

- Complex Withdrawal Rules: Complex rules around when and how you can access funds

- No Tax Distribution Benefits: Cannot distribute income to lower-tax-rate beneficiaries like a Family Trust

Self Managed aims to make maintaining a Family Trust and Corporate Beneficiary so simple that Education Bonds are no longer required. The same tax benefits and asset protection can be achieved with much greater flexibility and lower costs through proper structuring.

Asset Protection Using Trusts

One of the key benefits of using trusts is asset protection - protecting your assets from creditors, lawsuits, and business failures. Assets held in a trust are separate from your personal assets, providing a layer of protection that individual ownership doesn't offer.

Protection from Lawsuits

If you're sued personally, assets held in a Family Trust are generally protected from your personal creditors. This is because the trust is a separate legal entity, and the assets belong to the trust, not to you personally.

Example: Being Sued

Imagine you're a professional (doctor, lawyer, consultant) and you're sued for malpractice or negligence. If you lose the case and face a large judgment:

- Personal Assets: Your personal bank accounts, car, and personal property could be at risk

- Trust Assets: Investment properties, shares, and other assets held in your Family Trust would be protected from the lawsuit

- Result: Your family's wealth and investments remain protected, allowing you to continue providing for your family even after a significant legal loss

Protection from Business Failure

If you run a business, holding business assets in a trust can protect them if the business fails. This is particularly important for valuable assets like property, intellectual property, or domain names that you want to keep even if the business doesn't succeed.

Example: Business Assets in Trust

Consider a scenario where you run a business that fails:

- Business Assets in Company: If your business property or website domain is held in the trading company, creditors can seize these assets when the business fails

- Business Assets in Trust: If you hold the property or domain in a Family Trust and lease it to your business, these assets are protected from business creditors

- Result: Even if the business fails and goes bankrupt, you retain ownership of the property or domain, which can be leased to a new business or sold separately

This structure is commonly used by business owners who want to protect valuable assets like commercial property, intellectual property, or digital assets (websites, domains) from business risks while still using them in their business operations.

Structure Comparison

Family trusts and SMSFs give you the best structures to mitigate tax and risk. Here's how they compare:

| Structures | Individual | Family Trust | Retail Super | SMSF | SMSF Pension |

|---|---|---|---|---|---|

| Choice of Asset | Yes | Yes | Partial | Yes | Yes |

| Holding Fees | No | $3,000 | 0.5% | $1,500 | $1,500 |

| Income Tax Rate | 47% | <27% | 15% | 15% | 0% |

| CGT Rate | 24% | <14% | 10% | 10% | 0% |

| Bankruptcy Protection | No | Yes | Yes | Yes | Yes |

Real-World Example: The Power of Self Managed Strategies

Consider this example where implementing SMS strategies results in significant financial improvement:

Before Self Managed

- $150,000 annual salary

- No salary sacrifice beyond super guarantee

- $200,000 super balance in retail fund (1% fees)

- $1,500,000 interest-only home loan at 6.8%

- $1,000,000 investments in personal name

- 8% investment returns (all as income)

- $74,238 income tax paid annually

Result: Only 1.5% annual wealth increase

After Self Managed

- $150,000 annual salary

- Salary sacrifice to reach $30,000 cap

- $200,000 super in SMSF with 3 other members ($250 fees)

- $1,500,000 principal & interest home loan at 6.3%

- Debt recycling implemented

- $1,000,000 investments in family trust (3% income, 5% growth)

- $4,783 income tax paid annually

Result: 5.8% annual wealth increase (300% improvement)

Key Takeaway: In this example, the same income and investments with SMS structures and strategies produced a 300% improvement in yearly wealth accumulation, without changing the underlying investment returns.

How Self Managed Simplifies Structure Management

Managing Family Trusts, Companies, and SMSFs can seem complex, but Self Managed makes it simple by providing all the tools and automation you need:

Templates and Documents

Self Managed provides all the templates you need to set up and manage your structures:

- Trust Deeds: Complete trust deed templates for Family Trusts with all required clauses

- Company Constitutions: Standard company constitutions ready to customize

- Distribution Resolutions: Templates for making distribution nominations before year-end

- Beneficiary Statements: Automated generation of beneficiary distribution statements

- Dividend Statements: Templates for company dividend statements

- Director Resolutions: Templates for solvency resolutions and director appointments

Automated Reminders

Self Managed creates reminders to ensure you never miss important compliance deadlines:

- Distribution Deadlines: Reminders to make distribution nominations before June 30

- Tax Return Deadlines: Reminders for lodging trust, company, and SMSF tax returns

- ASIC Annual Reviews: Reminders for company annual reviews and fee payments

- SMSF Audit Deadlines: Reminders to complete annual SMSF audits

- Solvency Resolutions: Reminders for annual company solvency resolutions

- Investment Strategy Reviews: Reminders to review SMSF investment strategies

Tax Return Preparation and Submission

Self Managed prepares and submits your tax returns directly to the ATO:

- Trust Tax Returns: Automatically prepares trust tax returns with all required supplementary forms (trust income, capital gains)

- Company Tax Returns: Prepares company tax returns with financial statements and dividend reporting

- SMSF Annual Returns: Prepares SMSF annual returns with member statements and compliance reporting

- Beneficiary Statements: Generates and distributes beneficiary statements for inclusion in personal tax returns

- Direct ATO Submission: Submits all returns directly to the ATO, eliminating the need for separate tax agents

- Compliance Tracking: Tracks all lodgements and provides confirmation of successful submissions

Simplified Management

With Self Managed, what used to require hours of work each year and thousands of dollars in professional fees can now be managed in minutes. The platform handles the complexity, so you can focus on making investment decisions rather than compliance paperwork.

Structuring Strategy Summary

Choosing the right structures can significantly impact your wealth building:

- SMSF: Best for retirement savings with full investment control and tax benefits

- Family Trust: Ideal for income distribution and asset protection

- Company: Effective for high-income individuals to cap tax rates and protect business assets

- Unit Trust: Limited use cases - mainly for joint investments with non-family members

- Education Bonds: Family Trust + Corporate Beneficiary provides better flexibility

The key is to use the right structure for the right purpose, often combining multiple structures to optimize tax, protection, and flexibility.