Is a Family Trust still worth it in 2026? A DIY cost-benefit analysis

For Australian families weighing tax savings, asset protection, and ongoing effort.

Bottom line: A Family Trust is usually worth it when you have $100k+ in investable assets or one partner is already in a higher tax bracket. The DIY work is simple if you track bank feeds, record distributions, and complete June 30 resolutions. Self Managed automates those steps and helps you quantify the upside with the tax minimisation simulator.

This is general information only. Trust rules change and your circumstances matter. If unsure, get professional advice.

What a trust actually does (in plain English)

A Family Trust is a legal structure that holds assets on behalf of beneficiaries. The trustee controls distributions, which lets you allocate income to the people in your family who pay the least tax. That’s the main reason a trust can be worth it.

- Tax flexibility: Stream income to lower-tax beneficiaries or a corporate beneficiary.

- Asset protection: Trust assets are separate from personal assets.

- Succession planning: Assets can move through generations without selling.

In practice, a trust gives you flexibility and protection, but you must document distributions properly. The tax benefits only apply when the records show who received the income and why.

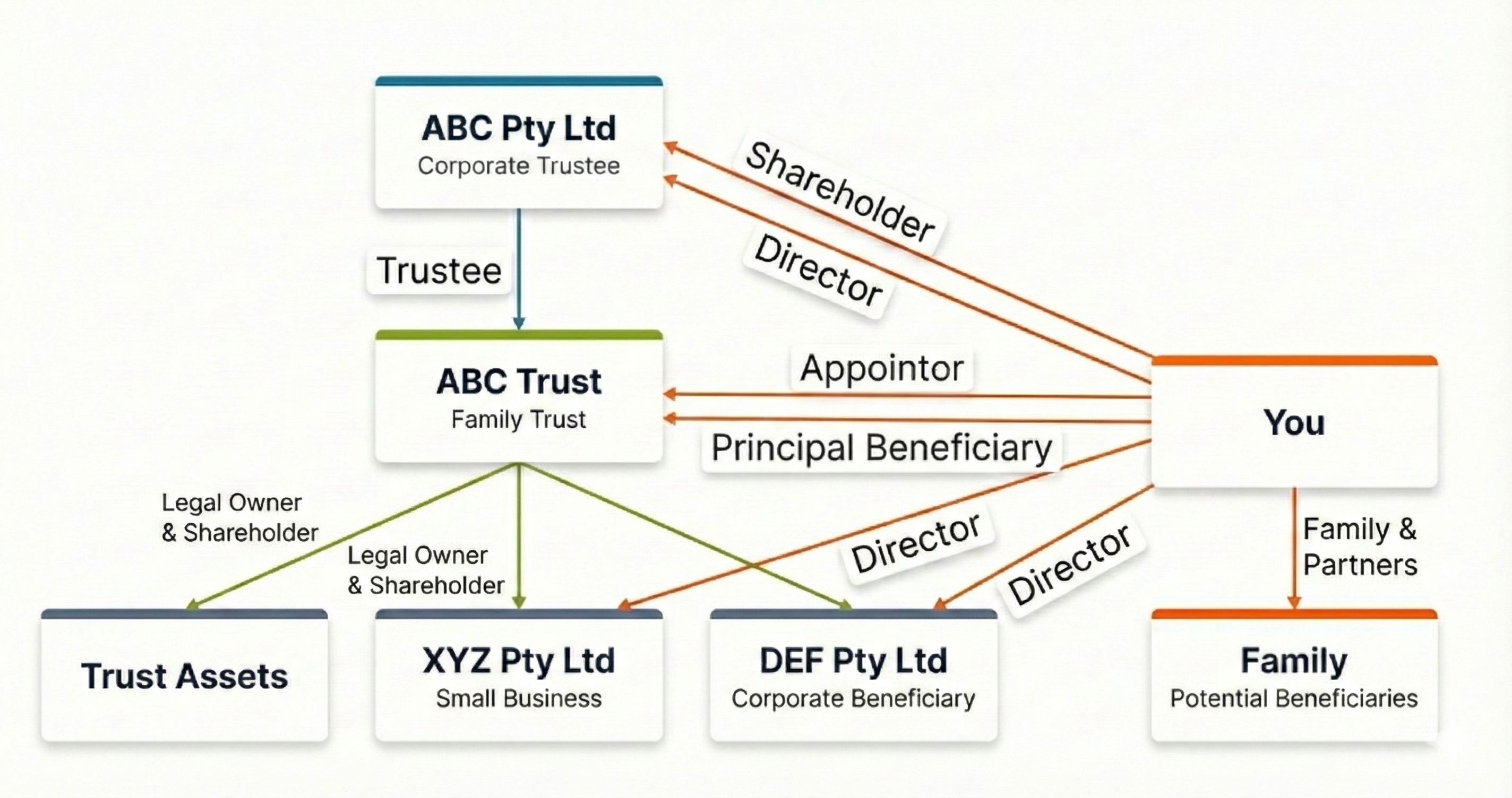

Typical trust structure

This simple structure shows how trustees, beneficiaries, and a corporate beneficiary connect:

A family trust structure with a corporate trustee and corporate beneficiary.

The 2026 cost-benefit reality check

The question is not “Should I have a trust?” but “Is the annual saving bigger than the annual effort and fees?”

| Item | Typical cost | DIY alternative |

|---|---|---|

| Annual tax return prep | $1,500 - $3,000 | Automate records + export summaries |

| Year-end resolutions | Often bundled | Resolution generator + reminders |

| Ongoing bookkeeping | Hourly or monthly fees | Bank feeds and categorisation |

Use the tax minimisation simulator to test your household income and compare outcomes across structures.

When a Family Trust is usually worth it

- You have $100k+ in investable assets outside super.

- One spouse is on a higher marginal tax rate.

- You want to protect assets from business risk or personal liability.

- You are building intergenerational wealth and want flexibility.

If you have minimal investments and no income flexibility, a trust may not yet pay for itself.

Cost of compliance: accountant vs DIY

| Cost line item | Traditional accountant | DIY with Self Managed |

|---|---|---|

| Annual compliance | $2,000 - $5,000 | $200 - $1,000 (time + subscription) |

| Record clean-up | Hourly or bundled | Handled monthly by you |

| Distribution paperwork | Included | Templates + reminders |

Case study: the Jones family

One partner earns $180k and the other earns $40k. They hold $250k in shares and a property. If all income stays in the high earner’s name, the marginal tax rate is high. By distributing trust income to the lower earner (and potentially a corporate beneficiary for retained earnings), the effective tax rate drops and the annual savings can be material.

The exact benefit depends on your income mix. Model your own scenario in the tax minimisation simulator.

The 15-minute monthly trust workflow

Most of the “hard work” is just maintaining clean records. A simple DIY process looks like this:

- Import bank feeds: Keep transaction data current.

- Categorise income and expenses: Keep trust activity distinct.

- Review distributions monthly: Track who is receiving what.

- June 30 resolutions: Finalise distributions before year end.

- Export summaries: Prepare clean data for tax return lodgement.

June 30 checklist: avoid the 47% tax rate

If your distributions are not documented by June 30, the trust can be taxed at the top marginal rate. This is the single biggest DIY risk.

- Confirm beneficiaries and their tax brackets.

- Prepare a distribution resolution before June 30.

- Generate beneficiary statements after year end.

- Store supporting records and meeting minutes.

Section 100A and genuine benefit

Trust distributions must create a genuine benefit for the beneficiary. Avoid circular transfers, undocumented loans, or paper distributions that do not reflect real outcomes. If you keep clear records and supporting notes, you reduce risk.

For deeper detail, see the Section 100A guide.

Asset protection: the “vault” effect

Trusts can separate personal risk from family assets. If you run a business or have professional risk, holding investments in a trust can reduce exposure.

If you are sued personally, assets held in your Family Trust are generally outside personal claims, subject to the trust deed and legal context.

Corporate beneficiary (bucket company) in plain English

When all individual beneficiaries are already in higher tax brackets, a corporate beneficiary can cap tax at the company rate. This is an advanced strategy and needs proper documentation, but it can help smooth income over multiple years.

Trust vs alternatives (quick comparison)

- Personal ownership: Simple but no income streaming or asset protection.

- Company: Tax cap but less distribution flexibility.

- SMSF: Best for retirement assets, not for general family income.

DIY vs accountant: what you still need help with

DIY works best for clean, routine data. You may still want professional advice for:

- Complex distributions or unusual beneficiary arrangements.

- Trust deed variations or changes to appointors.

- Related-party loans or Division 7A interactions.

Frequently asked questions

No. Many households benefit once they reach $100k+ in investable assets or have income flexibility across beneficiaries.

Yes. Trustees can manage their own records and lodgements, but they remain responsible for compliance.

The trust may be taxed at the top marginal rate on undistributed income. Use reminders and resolution templates to stay on track.

About the author

Written by the Self Managed team based on experience supporting DIY trustees with Australian tax compliance.

Last updated

January 2026

Next step: model your savings

Before you decide, run your own numbers in the tax minimisation simulator and compare a trust vs personal ownership.